Introduction

Agile development - the iterative and flexible approach to software development - is increasingly seen as the cornerstone of innovation in financial technology (FinTech). As the financial industry faces stringent regulation, market volatility and high customer expectations, agile offers a solution that promotes responsiveness, adaptability and customer-centricity. Here we explore detailed Agile approaches tailored to the dynamic world of FinTech services.

Understanding Agile in FinTech

FinTech companies are turning to Agile to navigate the complex waters of financial services. Agile’s core principles align with the need for rigorous testing, user-driven development, and the capability to respond swiftly to changes in the financial landscape.

- Embracing the Agile Mindset:

Enter the domain with an agile mindset, cultivating an organizational culture that values collaboration, continuous improvement and flexibility. This involves moving from traditional hierarchical structures to cross-functional teams that can pivot as the market demands.

- Customer Focus and Feedback:

In the world of finance, user trust and experience are paramount. Agile allows for constant customer feedback and iterative releases, ensuring that FinTech services are tailored to real user needs and regulatory requirements, and can also quickly adapt to feedback.

- Regulatory Compliance with Agile:

Agile's incremental approach to development ensures that FinTech services remain compliant with the ever-changing regulatory environment. Frequent iterations allow services to be constantly tested against regulatory standards, ensuring that compliance is built into the product from day one.

You may also interested in

Key Principles of Agile Methodology in Finance

This section will explore the foundational principles of Agile methodology in finance, focusing on how these principles can be applied to financial institutions and FinTech services to improve efficiency, compliance, and customer satisfaction.

Collaboration Over Process

- In finance, cross-functional collaboration is crucial. Agile fosters collaboration between IT, compliance, and finance departments, ensuring that financial products and services are well-rounded and meet all regulatory requirements.

Incremental Development and Feedback Loops

- Explain how Agile project management in finance focuses on delivering in increments, gathering feedback from stakeholders at every stage. This reduces the risk of large-scale failures and ensures that products are developed with real-time data.

Flexibility and Responsiveness to Change

- Financial markets can shift rapidly due to regulatory changes or economic volatility. Agile for finance teams allows quick pivots, enabling financial services to remain relevant and adaptable in real-time.

Agile vs. Traditional Project Management in Financial Services

When comparing Agile development to traditional project management within financial services, several key differences emerge. Below is a comparative overview to help understand the distinctive features and advantages of each approach.

In the fast-paced and regulation-heavy financial services industry, choosing the right project management approach can significantly impact the success and compliance of a project. Agile methodologies offer flexibility and continuous improvement, making them particularly suited to projects where requirements are unclear or likely to change. Traditional project management, with its structured and linear approach, may be more appropriate for projects with well-defined goals and timelines.

Best Practices for Implementing Agile Financial Management

Implementing Agile financial management requires a strategic approach to adapt the methodology to the nuanced needs of the financial sector. Here are some best practices to ensure a successful transition and implementation:

Start Small and Scale

Begin with a pilot project or team to adopt Agile practices. This allows you to test methodologies, adapt processes, and learn from mistakes on a small scale before a full-scale implementation.

Embrace a Cultural Shift

Agile transformation is as much about changing mindsets as it is about changing processes. Foster a culture of openness, collaboration, and continuous improvement, where feedback is valued and acted upon.

Focus on Customer Value

Prioritize work that delivers the most value to customers. This customer-centric approach ensures efforts are aligned with delivering outcomes that truly matter to end-users.

Enhance Collaboration Across Teams

Break down silos between departments and promote cross-functional teams. Agile thrives on collaboration, and closer ties between finance, development, and operations can lead to more coherent and flexible financial management.

Invest in Continuous Learning

The financial landscape is constantly evolving, and so should your Agile practices. Encourage ongoing learning, training, and development to keep pace with best practices and innovations in Agile financial management.

Use the Right Tools

Leverage Agile project management tools that offer transparency, real-time communication, and flexibility. Tools that support Agile workflows can streamline processes and enhance collaboration.

Agile for Finance Teams: Overcoming Common Challenges

Agile methodologies offer numerous benefits, but finance teams may face unique challenges in adopting this flexible and iterative approach. Here’s how to address some common obstacles:

Balancing Agility with Compliance

Financial institutions operate in a highly regulated environment. To reconcile agility with strict regulatory requirements, embed compliance checks in every iteration and maintain transparent documentation throughout the Agile lifecycle.

Managing Distributed Teams

In today’s globalized world, finance teams often work across locations. Utilize digital communication and collaboration platforms to ensure all team members, regardless of location, are aligned and can contribute effectively.

Shifting from Fixed Budgets to Adaptive Financing

Moving away from annual budgeting to a more flexible funding model can be challenging. Adopt incremental funding, where budgets are adjusted based on project needs and outcomes, allowing for more agility in financial planning.

Dealing with Resistance to Change

Change can be met with resistance. Engage stakeholders early and often, highlighting the benefits of Agile for enhancing responsiveness, improving product quality, and increasing customer satisfaction.

Integrating Agile Across the Organization

For Agile to be truly effective, it should not be isolated within teams. Strive for an enterprise-wide Agile adoption, where Agile principles guide not just project management but strategic planning and corporate culture.

By adopting these best practices and addressing challenges head-on, finance teams can effectively leverage Agile methodologies to achieve greater efficiency, innovation, and customer satisfaction in their financial management processes.

How Meegle Enhances Agile Financial Management for FinTech Companies

Adopting Agile techniques in Financial Technology Services using Meegle involves a few key steps. This process utilizes Meegle's robust project management capabilities to drive iterative development, stakeholder collaboration, and responsive adaptation to changes.

Here's how you can do it:

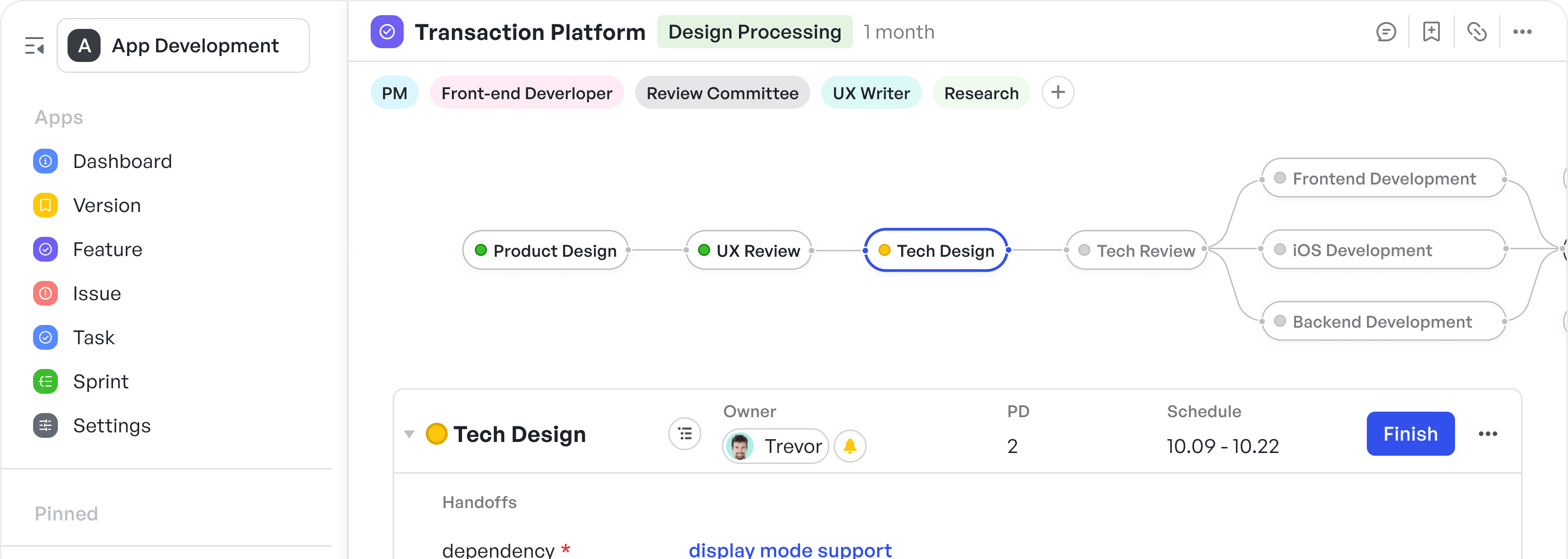

Set Up Agile Teams

Create diverse and cross-functional teams using Meegle's ' Roles and Members' feature. Each team should have a blend of roles necessary for project completion to ensure self-sufficiency.

250px|700px|reset

加载中,请稍后

Define Sprints

Lay out your project timeline into smaller, manageable iterations known as Sprints using Meegle's 'Timelines' feature. Sprints typically last 1-4 weeks, with a list of deliverables expected at the end of each.

250px|700px|reset

加载中,请稍后

Establish a Backlog

Use the 'Tasks' feature to create a prioritized list of tasks, known as a product backlog. This list is comprehensive and includes everything that needs to be done in the project.

250px|700px|reset

加载中,请稍后

Implement Kanban Boards

Use Meegle's Kanban boards to visualize tasks by categories such as 'To do', 'In-progress', and 'Done.' This visual arrangement facilitates better workflow management and allows for real-time tracking of task progress.

250px|700px|reset

加载中,请稍后

Automation and Notifications

- Make ample use of Meegle’s automation features and notifications. Automate certain processes like notifications for task deadlines or updates, reminders, and batch operations handling multiple tasks simultaneously.

250px|700px|reset

加载中,请稍后

Visualize Workload

Meegle offers a clear visual representation of each team member's workload, allowing managers to see who is overburdened or underutilized at a glance. Managers can assign tasks with specific time allocations to team members, and adjust these assignments dynamically to address any imbalance in workload distribution.

250px|700px|reset

加载中,请稍后

Conclusion

The Agile approach is well-suited to the financial technology sector's demands. By delivering quickly, responding to change, and focusing on the customer, Agile allows FinTech services to innovate and thrive in a dynamic industry. Adopting Agile practices helps companies stay at the forefront of the financial landscape, delivering services that are not only compliant and thoroughly tested but also resonant with what customers need-secure, reliable, and user-friendly financial solutions.

Embracing Agile can set a financial technology service apart, enabling it to adapt readily in this fast-evolving industry landscape.

FAQs About Agile Methodology in Financial Services

- What is Agile methodology in finance?

Agile methodology in finance involves applying the principles of Agile—such as iterative development, responsiveness to change, and stakeholder collaboration—to financial operations and project management. This approach aims to enhance efficiency, innovation, and customer satisfaction in financial services.

- How does Agile improve compliance in financial services?

Agile improves compliance by integrating regulatory and compliance considerations into every phase of the project lifecycle. Its iterative nature allows for frequent revisits and adjustments, ensuring that projects remain compliant as regulations evolve and new requirements emerge.

- Can Agile project management work for large financial institutions?

Yes, Agile project management can work for large financial institutions by breaking down large projects into manageable sprints, fostering cross-functional collaboration, and enhancing adaptability to change. Large institutions may adopt Agile at scale frameworks to systematically deploy Agile practices across various teams and departments.

- What are the key benefits of Agile financial management?

Key benefits include increased flexibility and adaptability to market changes, improved collaboration and communication within teams, enhanced customer focus through regular feedback, faster delivery of financial products and services, and better risk management through continuous oversight.

- How do finance teams handle security risks in Agile development?

Finance teams handle security risks in Agile development by incorporating security practices throughout the development process, often referred to as DevSecOps. This approach includes conducting security assessments and reviews at each stage of the Agile cycle, prioritizing security tasks alongside development tasks, and fostering a security-aware culture among all team members.