The finance industry operates in a rapidly changing environment where regulatory compliance, risk management, and customer expectations demand efficiency and agility.

Traditional project management approaches often struggle to keep up with market fluctuations, digital transformation, and evolving financial services.

This is where Scrum, an Agile framework, revolutionizes financial institutions by enabling teams to work in short, iterative cycles (Sprints) to adapt quickly, improve collaboration, and deliver continuous value.

From FinTech innovation and regulatory compliance to investment portfolio management and fraud detection, Scrum enhances decision-making, transparency, and efficiency in finance.

Boston Consulting Group's (BCG) latest research of over 127 distributed companies reveals that 94% have already embraced Agile practices. Even more compelling, about 48% of financial services firms have successfully transformed their operations with Agile, proving its value in driving efficiency.

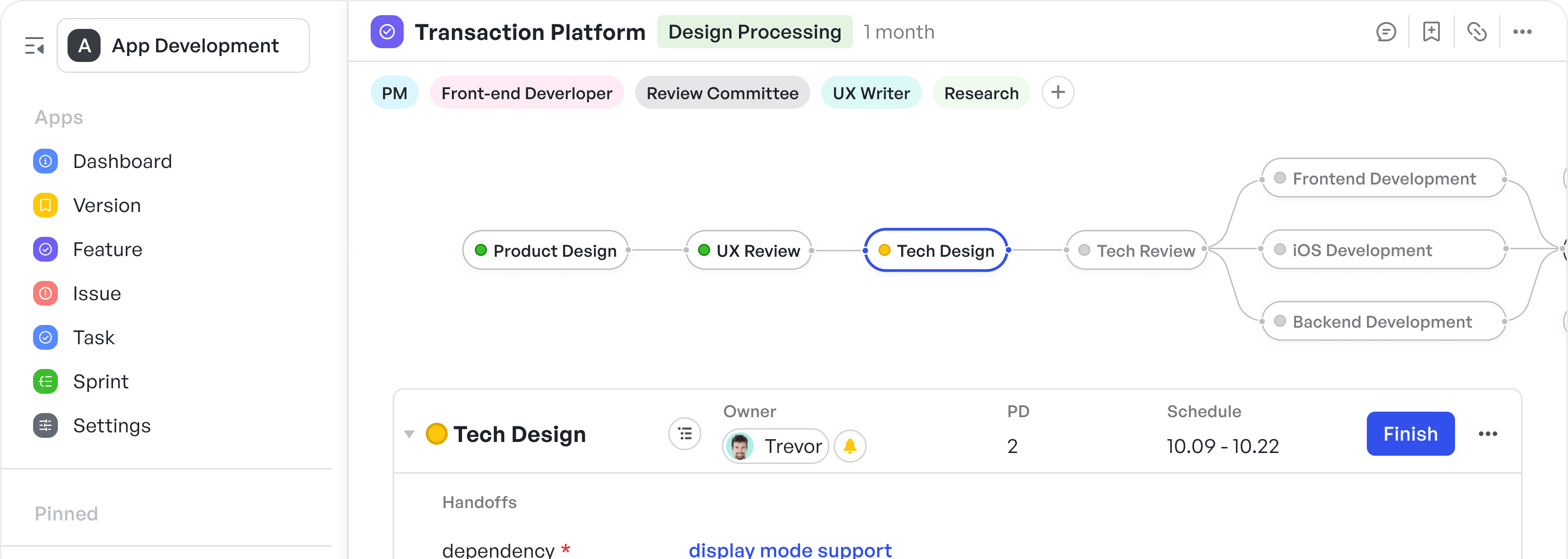

250px|700px|reset

加载中,请稍后

What is Scrum in finance?

Scrum is an Agile methodology that breaks down complex financial projects into manageable, time-boxed iterations (Sprints), allowing financial teams to:

- Develop and deploy new financial services more efficiently.

- Enhance risk management by continuously adapting to regulatory changes.

- Improve fraud detection algorithms by iterating and refining detection models.

- Optimize investment and portfolio management through iterative planning and analysis.

Core principles of Scrum in finance

- Transparency – Every stakeholder has visibility into project progress and financial forecasts.

- Inspection – Regular reviews help teams identify and mitigate financial risks early.

- Adaptation – Enables quick response to market shifts, regulatory updates, and economic conditions.

Scrum team roles in finance

- Product owner – Defines project objectives, prioritizes backlog items and ensure compliance with financial regulations.

- Scrum master – Facilitates Agile adoption, removes obstacles, and ensures smooth Sprint execution.

- Development team – Includes financial analysts, risk managers, compliance officers, and software developers working on Scrum tasks.

250px|700px|reset

加载中,请稍后

Key stages and roles in Scrum methodology

To maintain alignment with financial regulations and business strategy, financial teams often rely on a structured product roadmap to guide decision-making and development efforts.

Why implement Scrum in finance?

Key benefits of Scrum in finance

- Faster time-to-market – Enables quicker development of financial products and digital banking services.

- Improved risk management – Provides real-time visibility into financial data and regulatory compliance.

- Enhanced customer experience – Ensures continuous improvements to digital banking platforms and investment solutions.

- Greater operational efficiency – Reduces bottlenecks in finance workflows, approvals, and compliance processes.

- Increased team collaboration – Fosters better communication between finance, compliance, and IT teams.

Scrum adoption in finance: Key statistics

- 86% of marketer firms plan on implementing or are transitioning to Agile project management methodologies

- About 13% of financial departments have adopted Agile principles and practices.

- Agile adoption in banking and finance has led to a 50% reduction in software defects reported by a bank.

By leveraging Scrum, finance teams can increase adaptability, minimize risk exposure, and accelerate financial product innovation.

How to implement Scrum in finance

Step 1: Establish the Scrum framework

Before implementing Scrum, financial organizations must define their Scrum structure, sprint duration, and key team roles.

250px|700px|reset

加载中,请稍后

Identify key roles and responsibilities in Meegle

Key steps to setting up Scrum in finance

- Identify key Scrum team members, including financial analysts, risk specialists, compliance officers, and developers.

- Define Sprint durations, typically two to four weeks, depending on project complexity.

250px|700px|reset

加载中,请稍后

Meegle Sprint board

- Establish a Scrum Board (physical or digital) to track progress on financial initiatives.

- Set clear regulatory and security guidelines to ensure financial compliance.

Scrum teams in finance often align their development efforts with a product roadmap to maintain strategic focus while balancing risk and innovation.

Step 2: Define and prioritize the financial backlog

The product backlog in finance consists of features, compliance updates, risk assessments, and financial model improvements.

How to manage a financial backlog effectively

- Break down complex financial projects into smaller, measurable tasks.

- Prioritize backlog items based on regulatory deadlines, market demands, and risk assessments.

- Ensure backlog items are continuously refined to accommodate changes in financial regulations.

A well-maintained backlog ensures transparency and strategic alignment across financial projects.

Step 3: Sprint planning and task allocation

Sprint planning ensures that finance teams focus on high-impact work while balancing regulatory and risk concerns.

Sprint planning best practices for finance

- Define clear Sprint goals, such as enhancing a fraud detection system or improving automated loan approvals.

- Assign responsibilities to finance, compliance, and IT professionals to ensure cross-functional collaboration.

- Break down high-level initiatives into bite-sized, achievable tasks for Sprint execution.

250px|700px|reset

加载中,请稍后

Granular breakdown of large tasks (FE dev) into bite-sized bits for more control

Careful planning ensures financial teams deliver value while maintaining compliance and security standards.

Step 4: Sprint execution and daily stand-ups

During the Sprint, teams hold daily stand-up meetings to ensure alignment and track financial project progress.

Key topics in a finance stand-up

- Financial models or compliance reports completed since the last update.

- Next steps, including risk assessments or financial trend analyses.

- Any obstacles, such as regulatory approval delays or security concerns.

Using Agile tools to track Sprint execution and performance ensures teams can quickly address financial risks and compliance issues.

Step 5: Sprint review and retrospective

At the end of each Sprint, the finance team conducts a Sprint review and retrospective to assess completed work and identify areas for improvement.

- Sprint review: Demonstrates new features, compliance updates, or financial model optimizations to stakeholders.

- Sprint retrospective: Discusses what went well, challenges faced, and strategies for improvement in the next Sprint.

Continuous feedback loops enable financial teams to optimize processes, reduce risk, and enhance financial decision-making.

Best practices for a successful Scrum implementation in finance

- Leverage secure Agile tools

- Leverage secure Agile tools

Financial institutions must use highly secure Agile tools to protect sensitive data while managing financial workflows. Meegle's Agile template provides a structured framework so you can customize your Sprint planning right away and drive continuous delivery for your projects.

- Foster cross-department collaboration

- Foster cross-department collaboration

Scrum thrives when finance, risk management, IT, and compliance teams work together on shared goals.

- Automate repetitive financial processes

- Automate repetitive financial processes

Streamlining manual auditing, reporting, and compliance checks improves efficiency and reduces operational risks.

- Maintain a well-defined product roadmap

- Maintain a well-defined product roadmap

Aligning Scrum initiatives with a long-term product roadmap ensures strategic growth and regulatory compliance.

- Integrate risk management strategies

- Integrate risk management strategies

Understanding financial risk management methodologies ensures that Scrum teams can proactively mitigate regulatory and market risks.

Conclusion

Scrum transforms financial institutions by accelerating product development, improving compliance management, and enhancing financial risk assessment. By adopting Scrum, finance teams can:

- Respond quickly to market fluctuations and regulatory changes.

- Develop innovative digital financial services efficiently.

- Enhance fraud detection and risk mitigation strategies.

- Increase team productivity and operational agility.

By integrating Scrum into financial operations, institutions can achieve greater agility, minimize risks, and drive continuous innovation. To easily transition your team into an efficient Agile culture, you need a platform that can bend and custom fit to your finance company/department's needs. Try Meegle out for free today to get started!