Introduction

Agile development - the iterative and flexible approach to software development - is increasingly seen as the cornerstone of innovation in financial technology (FinTech). As the financial industry faces stringent regulation, market volatility and high customer expectations, agile offers a solution that promotes responsiveness, adaptability and customer-centricity. Here we explore detailed Agile approaches tailored to the dynamic world of FinTech services.

Understanding Agile in FinTech

FinTech companies are turning to Agile to navigate the complex waters of financial services. Agile’s core principles align with the need for rigorous testing, user-driven development, and the capability to respond swiftly to changes in the financial landscape.

- Embracing the Agile Mindset:

Enter the domain with an agile mindset, cultivating an organizational culture that values collaboration, continuous improvement and flexibility. This involves moving from traditional hierarchical structures to cross-functional teams that can pivot as the market demands.

- Customer Focus and Feedback:

In the world of finance, user trust and experience are paramount. Agile allows for constant customer feedback and iterative releases, ensuring that FinTech services are tailored to real user needs and regulatory requirements, and can also quickly adapt to feedback.

- Regulatory Compliance with Agile:

Agile's incremental approach to development ensures that FinTech services remain compliant with the ever-changing regulatory environment. Frequent iterations allow services to be constantly tested against regulatory standards, ensuring that compliance is built into the product from day one.

Key Principles of Agile Methodology in Finance

This section will explore the foundational principles of Agile methodology in finance, focusing on how these principles can be applied to financial institutions and FinTech services to improve efficiency, compliance, and customer satisfaction.

Collaboration Over Process

- In finance, cross-functional collaboration is crucial. Agile fosters collaboration between IT, compliance, and finance departments, ensuring that financial products and services are well-rounded and meet all regulatory requirements.

Incremental Development and Feedback Loops

- Explain how Agile project management in finance focuses on delivering in increments, gathering feedback from stakeholders at every stage. This reduces the risk of large-scale failures and ensures that products are developed with real-time data.

Flexibility and Responsiveness to Change

- Financial markets can shift rapidly due to regulatory changes or economic volatility. Agile for finance teams allows quick pivots, enabling financial services to remain relevant and adaptable in real-time.

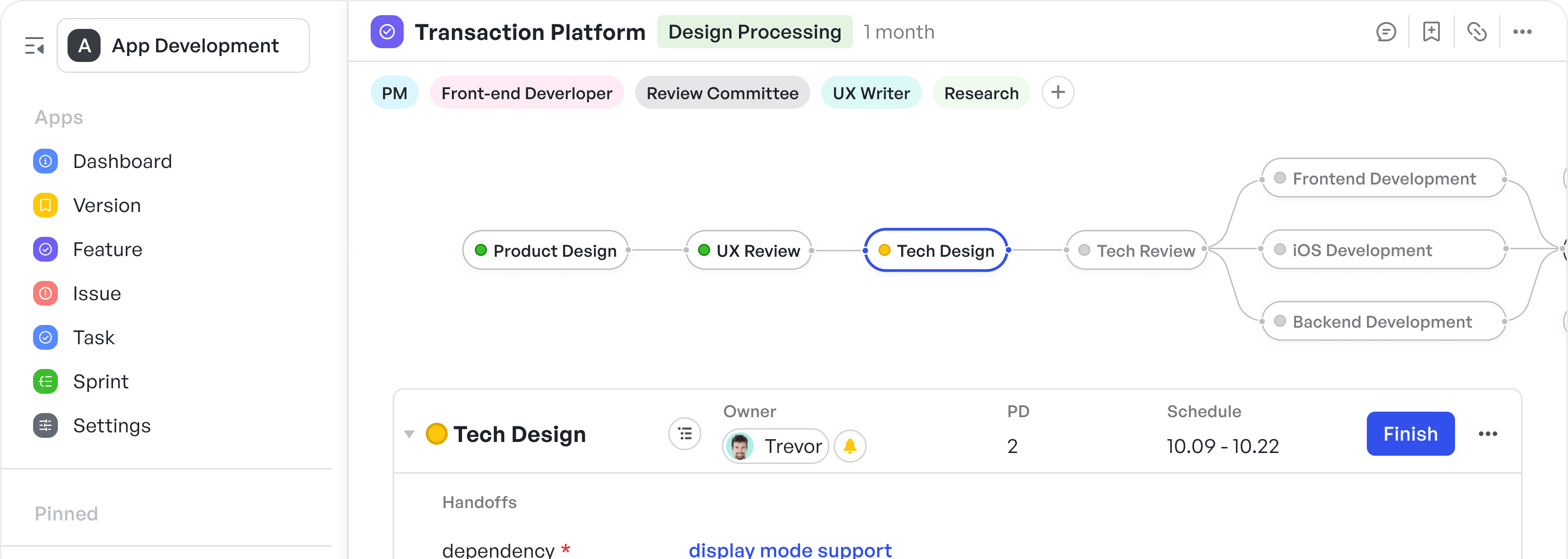

How Meegle Enhances Agile Financial Management for FinTech Companies

Adopting Agile techniques in Financial Technology Services using Meegle involves a few key steps. This process utilizes Meegle's robust project management capabilities to drive iterative development, stakeholder collaboration, and responsive adaptation to changes.

Here's how you can do it:

Set Up Agile Teams

Create diverse and cross-functional teams using Meegle's ' Roles and Members' feature. Each team should have a blend of roles necessary for project completion to ensure self-sufficiency.

250px|700px|reset

加载中,请稍后

Define Sprints

Lay out your project timeline into smaller, manageable iterations known as Sprints using Meegle's 'Timelines' feature. Sprints typically last 1-4 weeks, with a list of deliverables expected at the end of each.

250px|700px|reset

加载中,请稍后

Establish a Backlog

Use the 'Tasks' feature to create a prioritized list of tasks, known as a product backlog. This list is comprehensive and includes everything that needs to be done in the project.

250px|700px|reset

加载中,请稍后

Implement Kanban Boards

Use Meegle's Kanban boards to visualize tasks by categories such as 'To do', 'In-progress', and 'Done.' This visual arrangement facilitates better workflow management and allows for real-time tracking of task progress.

250px|700px|reset

加载中,请稍后

Automation and Notifications

- Make ample use of Meegle’s automation features and notifications. Automate certain processes like notifications for task deadlines or updates, reminders, and batch operations handling multiple tasks simultaneously.

250px|700px|reset

加载中,请稍后

Visualize Workload

Meegle offers a clear visual representation of each team member's workload, allowing managers to see who is overburdened or underutilized at a glance. Managers can assign tasks with specific time allocations to team members, and adjust these assignments dynamically to address any imbalance in workload distribution.

250px|700px|reset

加载中,请稍后

Conclusion

The Agile approach is well-suited to the financial technology sector's demands. By delivering quickly, responding to change, and focusing on the customer, Agile allows FinTech services to innovate and thrive in a dynamic industry. Adopting Agile practices helps companies stay at the forefront of the financial landscape, delivering services that are not only compliant and thoroughly tested but also resonant with what customers need-secure, reliable, and user-friendly financial solutions.

Embracing Agile can set a financial technology service apart, enabling it to adapt readily in this fast-evolving industry landscape.